25 year old male non-smoker has a 24% chance of having a critical illness (cancer, heart attack or stroke) prior to turning age 65. 1

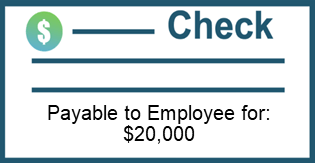

In the event of a critical illness your focus should be on your health, not your finances. A primary health insurance plan may cover some health care costs, but oftentimes the individual will face other financial challenges such as paying everyday living expenses while out of work, deductibles, co-insurance and copay fees, as well as other unexpected expenses. That’s when a Critical Illness/Cancer plan comes into play.

How it Works

[1] Study Reveals Risk of Having a Critical Illness Before Age 65.” www.criticalillnessinsuranceinfo.org. 2011 Critical Illness Insurance Buyer Study. American Association for Critical Illness Insurance and Gen Re. n.d. Web. Oct. 2011.