Unum Benefits – Open Enrollment EXTENDED until October 11th, 2023

Presentation: Monday, October 2nd @ 10am EST

Meeting ID: 314 208 603 086

Passcode: fss9C4

Unum Enrollment & Login Instructions

- Click the ‘Accept or Waive Benefits’ button above (If you have registered in previous years, you will still need to create a NEW registration below)

- Enter your Last Name

- Enter the last 4 digits of your SSN for the Employee ID

- Enter your Date of Birth (mm/dd/yyyy)

- Click Register

(Presented by Premier Worksite Benefits)

As an employee of Nordea Bank, you are eligible to participate in our Voluntary Benefits Program. Voluntary Benefits are offered to help address the individual needs of you and your family with advantages that otherwise might not be available to you on your own. Your voluntary benefit offerings are designed to complement your benefits package and provide additional security for you and your family.

All Employees: Unum Benefits are now online! Acceptance is Guaranteed for New Hires; therefore it is recommended for ALL NEWLY ELIGIBLE EMPLOYEES (Hired after 10/1/22) to login and register as a new user to Accept or Waive the Unum benefits.

What do you get?

Options: You may choose your level of coverage; one that both fits your needs and is easy on your paycheck. Your decision will not change the benefits being provided under any employer-sponsored benefit program.

Convenience: Voluntary benefits are paid through the convenience of payroll deduction

Acceptance: In many cases, you and immediate family members will have a better opportunity to obtain coverage through this offering than you would on your own, especially if any medical conditions or concerns are present.

Portability: Many of these programs may be taken with your with no change in premium or benefit if you leave employment or retire.

Permanent & Term Life Insurance

Life Insurance helps take care of your loved one’s immediate and future financial needs following your death. Immediate needs can include burial/funeral expenses, uninsured medical costs and current bills and debts. Future needs could include income replacement, education plans, ongoing family obligations, emergency funds, and retirement expenses.

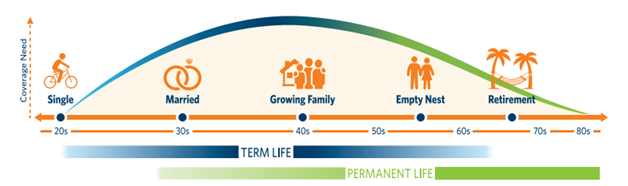

As people move through the stages of life, certain factors dictate the type of life insurance they need. During working years, an employer may provide Term Life insurance, but the Unum Whole Life product is designed to last for the remainder of your life and can help give peace of mind because the money you spend builds cash value that you can use later in life or add to the term benefit payout. The graph below illustrates the need for term and permanent whole life insurance throughout the various stages of life.

Accident Insurance

Unexpected accidents can also mean unexpected out-of-pocket expenses. Hospital stays, medical or surgical treatments, dislocations or fractures, and transportation by ambulance can add up quickly and be very costly. Accident Insurance can help with some of these expenses so your finances can remain healthy.

- Guaranteed Acceptance – you may qualify for coverage regardless of health

- Benefits are paid directly to you – use the money however you see fit

- Coverage is available to you, your spouse and dependent children

- On and off the job coverage

Critical Illness Insurance

No one knows what lies ahead on the road of life. Will you suffer a stroke, a heart attack or be diagnosed with cancer? The signs pointing to a critical illness are not always clear and may not be preventable, but Critical Illness Insurance can help offer financial protection in the event you are diagnosed.

- Covers major illnesses – Policies generally cover illnesses such as cancer, heart attack, coronary artery disease, paralysis, kidney failure, and many more

- Paid regardless of ability to work – The payment is made in a tax-free lump sum and is not linked to your ability/inability to work

- Use the money for any purpose – You choose what you want to do with the money

- Wellness Benefit – (covered health screening tests) – $50 per covered person/calendar year

Hospital Indemnity

Visits and stays at a hospital can be costly. A Hospital Indemnity Plan can complement your medical coverage by helping to ease the financial impact of a hospitalization.

- Lump-sum cash benefit paid directly to you

- No deductible to meet to receive benefits

- No networks – freedom to choose your provider

Please see your Human Resources Team for how to enroll.

Basic Long Term Care – Employee Sponsored

- Level of Care: LTC Facility and 50% of Total Home Care (inlcudes Professional Home Care)

- Monthly Benefit: $6,000 Long Term Care Facility/50% Total Home Care (includes Professional Home Care)

- Benefit Duration: 3 years

Buy-Up Long Term Care – Employee Buy-Up Option

- Choice of $6k, $7k & $8k monthly benefit options

- Choice of 6 years or Unlimited Duration